When my grandpa passed away, I thought the hardest part would be moving on. I never expected him to start visiting me in my dreams with the same strange message every night. I didn’t want to believe it meant anything — until the day I finally gave in and went to the basement.

I don’t know if you’ve ever felt truly stuck — like you’re running in place while the world around you keeps moving. That’s my life in a nutshell. I’m 22, and I work as a cashier at a run-down grocery store. It’s the kind of job where you smile and nod while people barely make eye contact, praying your register doesn’t freeze up again.

A young male cashier | Source: Midjourney

The pay is terrible, and by the time I cover rent and utilities for my tiny apartment, there’s barely enough left for groceries.

Life wasn’t always like this, though. I grew up in my grandpa’s house — a cozy place with creaky floors and walls full of old family photos. He raised me and my older brother, Tyler, after our parents died in a car accident.

Grandpa did his best to give us a good life and taught me everything I know about working hard and being decent.

But Tyler? He couldn’t have been more different. Immediately we turned 18, we found out our parents had left us a small inheritance. It wasn’t a fortune, but it could’ve made life a little easier.

Close up of two young adult men | Source: Midjourney

Tyler didn’t care about sharing. He drained the account, borrowed money from Grandpa, and vanished without a word.

I haven’t seen him since.

Grandpa and I didn’t talk about Tyler much after that. It hurt too much. We focused on getting by, fixing things around the house, and spending weekends fishing at the lake. Those were the good days.

Grandpa and grandson fishing | Source: Midjourney

After Grandpa passed, I thought the hardest part was over. I thought the silence in the house, the empty chair at the table, and the quiet hum of memories would be the worst. But I was wrong.

It had happened all so fast. Just two weeks ago, I walked into the house after my shift, groceries in hand, and found him on the floor. His favorite sweater was soaked in spilled tea, and the crossword puzzle he’d been working on was half-finished on the coffee table.

I remember dropping the bags, screaming his name, and shaking him like he could wake up if I just tried hard enough.

A heart attack, the doctors said. Quick and unexpected. Nothing anyone could’ve done.

Doctor delivering bad news to a patient about losing a loved one | Source: Midjourney

At the funeral, I kept waiting for Tyler to show up. Not because I wanted him there but because it felt wrong for him not to be. But, as always, my brother didn’t care enough to show his face. Just me, a scattering of neighbors, and a casket I wasn’t ready to say goodbye to.

That’s when the dreams started.

It wasn’t weird at first. Of course, I’d dream about Grandpa — he was the only family I had left. In the dreams, we were back at the lake, sitting on that old wooden dock with our fishing rods, just like we used to.

Grandpa was the same as ever: his baseball cap tilted back, his sleeves rolled up, smiling like he didn’t have a care in the world.

A young man sleeping | Source: Midjourney

“Caught anything yet?” I asked him in one dream, watching my line float lazily in the water.

“Nah,” he said, grinning. “You’re scaring the fish with all that talking.”

I laughed, and for a moment, everything felt normal. But then, his face grew serious, and he leaned in close.

“Listen to me, kiddo,” he said. “Check the red box in my basement.”

The first time it happened, I woke up and shrugged it off. Grief does strange things to people. But the dreams didn’t stop. Every night, the same scene. The same words.

A young man seated in his bed at night | Source: Midjourney

“Check the red box in my basement.”

After a week, I couldn’t take it anymore.

“Fine, Grandpa,” I muttered one morning, standing at the top of the basement stairs. “Let’s see what all this is about.”

The air down there was heavy, like the weight of a thousand memories. And then I saw it — a splash of red peeking out from beneath a pile of old newspapers.

My heart started pounding. Could this really mean something?

The red box was exactly where Grandpa said it would be, sitting beneath a dusty stack of newspapers. For a second, I just stared at it, unsure if I was more relieved or freaked out.

Young man staring at a large red box in the basement | Source: Midjourney

“Well, Grandpa,” I muttered, wiping my palms on my jeans, “let’s see what was so important.”

The lid creaked as I opened it, and I couldn’t help but laugh. Inside was nothing but fishing gear — spools of line, a box of rusty hooks, and a set of lures. There was even the old reel Grandpa used to call his “lucky charm,” though I don’t think it ever actually caught anything.

I picked it up, turning it over in my hands. “Is this what all the fuss was about?” I chuckled. “You really got me worked up for a tackle box?”

Shaking my head, I set the reel back inside and closed the lid. Maybe the dreams were just my brain’s way of clinging to him. Maybe it was all nonsense.

Young man opening a large old red box in the basement | Source: Midjourney

As I turned to leave, my foot clipped the edge of a nearby box.

“Crap!” I hissed as the whole stack wobbled dangerously before collapsing in a chaotic crash. Dust filled the air, and I coughed, waving it away. “Seriously? Perfect.”

But as I bent down to start picking up the mess, something caught my eye — a metal door embedded in the wall behind where the boxes had been.

A safe.

An old safe with a large circular dial | Source: Midjourney

I froze, my heart hammering in my chest. “You’ve gotta be kidding me.”

It looked ancient, the kind with a big circular dial and no obvious keyhole. I crouched down, running my fingers over the cold metal.

“What’s the combination?” I muttered to myself, my mind racing.

I tried a few combinations, starting with Grandpa’s birthday. Nothing. Then I tried Tyler’s, just to see. Still nothing.

“Come on,” I muttered, wiping sweat from my forehead. Then, almost on instinct, I tried my own birthday.

Click.

Young man opening an ancient safe | Source: Midjourney

The sound echoed in the quiet basement, and I froze. Slowly, I pulled the door open, revealing neat stacks of cash — so much that I could hardly believe my eyes. Fifty thousand dollars, at least.

My hands shook as I reached in and pulled out a note tucked beneath one of the stacks. It was Grandpa’s handwriting, shaky but familiar.

“For my boy — everything I couldn’t give you in life. Use it to build something good, and don’t let the world beat you down. Love, Grandpa.”

Tears blurred my vision as I sat back, clutching the note. He’d left it for me. After everything, he’d left me the inheritance he must’ve saved bit by bit over the years.

Thousands of US dollar notes inside an ancient safe | Source: Midjourney

“Thanks, Grandpa,” I whispered. My voice cracked, but for the first time in weeks, I felt something close to hope.

The money changed everything.

I didn’t blow it on luxury or take the easy way out. Grandpa’s note kept playing in my mind: “Build something good.” And so, I did.

Six months later, the doors to Peter’s Coffee opened, a cozy little shop tucked on the corner of Main Street.

The walls were lined with fishing memorabilia — a framed picture of Grandpa and me at the lake, his lucky reel mounted above the counter, and even the old red box, now polished and displayed by the register.

A cozy, inviting coffee shop | Source: Midjourney

People loved it. Maybe it was the smell of fresh coffee or the warm, homey vibe. Maybe it was because it was personal. I made sure to tell every customer about the man behind the name, the one who gave me everything when he had so little.

I thought about Tyler, too. I tried calling him, left messages on the only number I had, and even sent an email. But, just like before, there was no answer. Part of me wanted to be angry, but another part just hoped he was okay.

Young man smiling in his cozy coffee shop | Source: Midjourney

One evening, as the shop closed for the night, I lingered behind the counter, wiping down tables. The fishing reel above the door caught the light, and I smiled.

“See, Grandpa?” I said softly, looking around the shop. “I did it.”

I swear I felt a warm breeze sweep through the room, even though the doors were shut.

And in my mind, I heard his voice, as clear as ever:

“You did good, kiddo. You did real good.”

A young man standing in his cozy coffee shop at night | Source: Midjourney

Curious about another family mystery? You’ll love this next one: At My Grandfather’s Funeral, a Stranger Handed Me a Note – When I Read It, I Laughed Because Grandpa Had Tricked Us. What did he leave behind?

This work is inspired by real events and people, but it has been fictionalized for creative purposes. Names, characters, and details have been changed to protect privacy and enhance the narrative. Any resemblance to actual persons, living or dead, or actual events is purely coincidental and not intended by the author.

The author and publisher make no claims to the accuracy of events or the portrayal of characters and are not liable for any misinterpretation. This story is provided “as is,” and any opinions expressed are those of the characters and do not reflect the views of the author or publisher.

How to Own Your Dream Home

For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

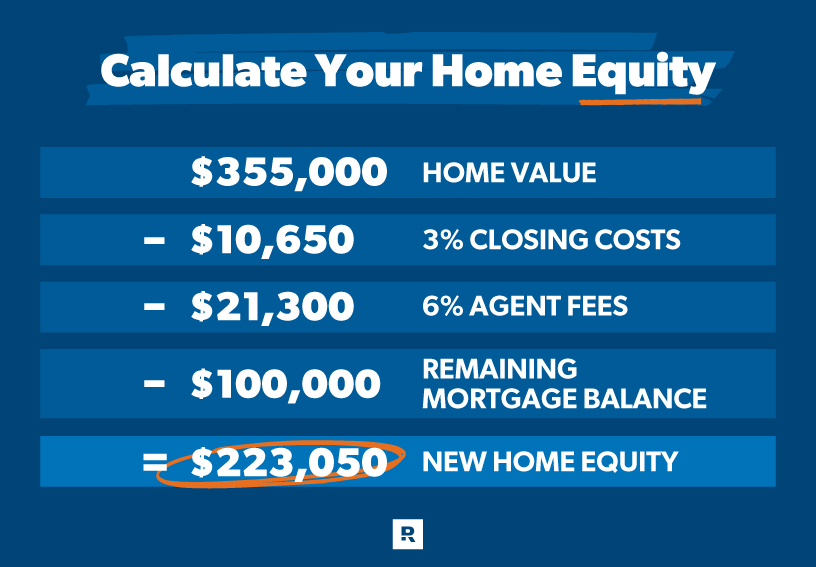

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

Leave a Reply