We occasionally follow paths in life that we never would have imagined. Although Frank Fritz was a well-liked character on television, he was going through a lot in his personal life.

This is his tragic tale…

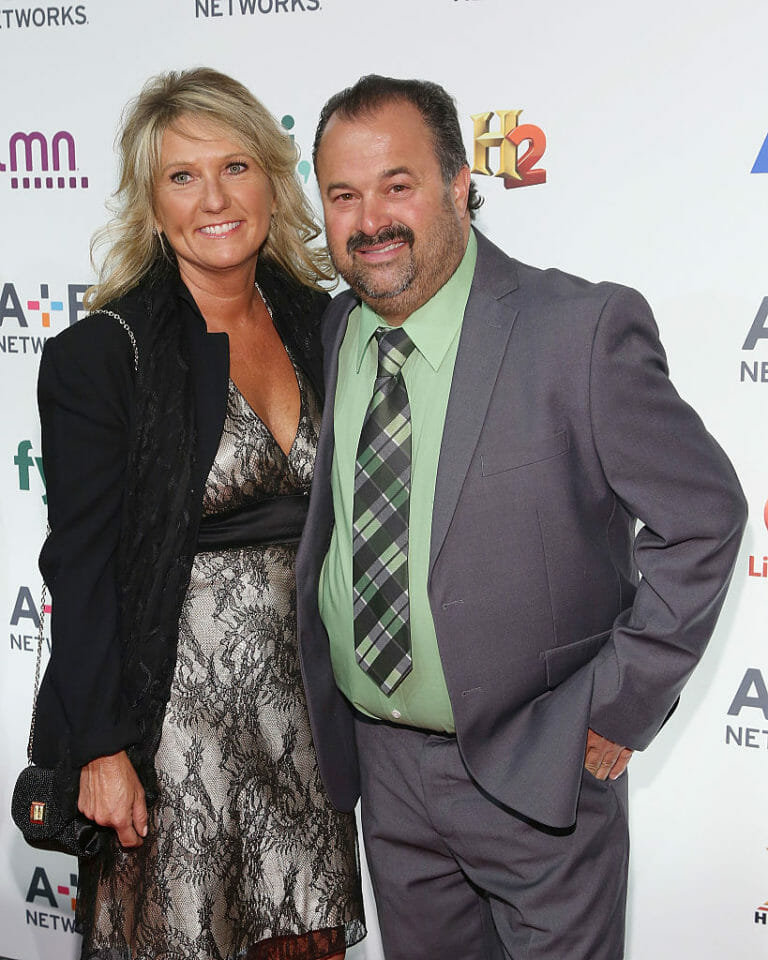

Longtime partner of Frank Fritz was Diann Bankson. His tumultuous split from her resulted in his drinking, unemployment, and even a medical emergency. Although the two are now permanently apart, their time spent together left a lasting impression on them both.]

At the age of 25, Frank Fritz, the host of “American Pickers,” first laid eyes on Diann Bankson. The pair intermittently dated before being engaged in 2017. They moved in together after purchasing an Iowa farmhouse a year later in 2018.

Their relationship, however, soured in November of that year when Bankson claimed to have “walked in” on Fritz and “caught him in bed with another woman.”

Fritz disclosed in an interview that Bankson had cheated on him and that he was even reminded of her “betrayal” by a tattoo. However, he declared his desire to wed her.

“I had planned to get married, had purchased a house and a very expensive ring, and was shocked to learn that my fiancée had been seeing someone else for the previous 2.5 years,” Fritz remarked.

Fritz stated, “She’s the cheater, which is why I got a tattoo saying ‘Once a cheater, always a cheater.’” He said that the tattoo was meant to act as a reminder to never do “the same mistake again.” And that Bankson had “cost” him a lot of money, he said.

He started drinking to heal his broken heart. That’s how he handled his heartbreak, he claimed. He lost a lot of weight as a result of this as well. “I gave it a good shot,” remarked Fritz. I made an attempt to drown her.

He overcame his drinking issue, but because the last relationship with Bankson had “stung hard enough,” he made the decision to put off dating for a while.

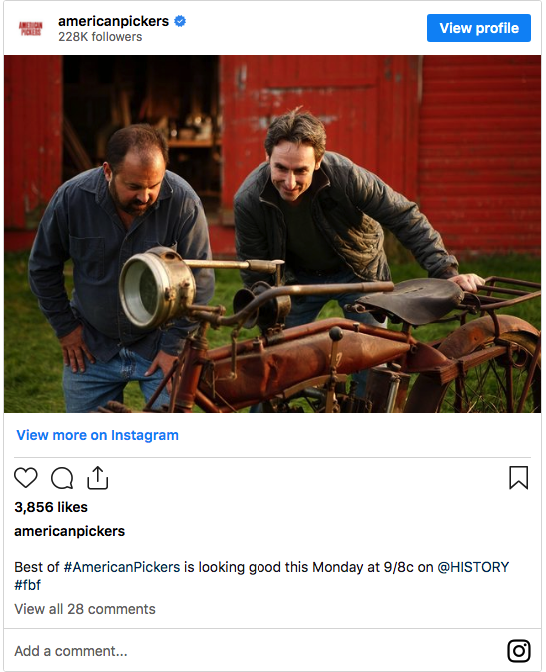

Following the split, he had losses in his career as well. The Sun claims that after March 2020, he stopped hosting History Channel’s “American Pickers.”

Fritz gave an explanation for his absence, saying that he intended to return to the show after the scar from his back surgery healed. “I would like to return to the show,” Fritz remarked. Now that I’m fully recovered, I’m prepared to resume my role on the show.

Fritz claimed there had been no definitive decision made by the show regarding his return. He said, though, that a showrunner had given him a call and assured him that he would return to the screen.

Despite Fritz having worked on the show for ten years, TMZ claims that the show has “no plans” to employ him as a host once more.

In addition to not returning to his show, Bankson’s ex-boyfriend Eric Longlett, an engineering administration manager, made his debut. She gushed about how fortunate she was to be with him in posts about him on social media.

“He took me to see Elton John’s Yellow Brick Road Farewell Tour,” she captioned a photo of herself and Longlett together at the concert. I’m a fortunate woman. Love you, sweetie. oxo

Fritz was hospitalized on July 4, 2022, following a stroke. After finding him on his house floor, his companion had phoned for assistance. The 911 call in which his friend stated, “He might be seizuring, I’m not sure,” was obtained by The US Sun.

Bill Fritz, Fritz’s father, told the reporters that his son was healing nicely and getting better every day.

His recuperation was not as complete as the physicians had hoped, though. After being discharged from the hospital, he was placed under guardianship and sent to a nursing home.

On August 18, 2022, his “longtime friend” reportedly filed an emergency appointment for temporary guardianship and conservatorship on his behalf, which was subsequently approved.

The bank was designated as his conservator to manage his finances, and his friend was named as his guardian.

In its capacity as his conservator, the bank would manage all of his care facility bills, including daily costs, health insurance, maintenance, and property tax payments. The bank would have to make sure he could get to events and doctor’s visits in a suitable manner.

In addition to being “in decision-making since the stroke,” his friend’s guardianship required that he submit a “initial care plan” for the patient.

In order to achieve this, his guardian would have to make decisions about his living situation, place of residence at the time, health, and medical requirements. They would also need to arrange for him to participate in activities, maintain communication with him and his loved ones, and pursue romantic relationships. It would also be expected of him to provide an annual report as his guardian.

His health was getting worse, according to his papers, and it was making it more difficult for him to make wise decisions for himself, “without which physical injury or illness may occur.”

Documents revealed that he was unable to “make, communicate, or carry out important decisions concerning his own financial affairs,” indicating that his condition was far worse than previously believed.

His guardian will have to make decisions on his behalf as he heals and is able to “receive treatment for his injuries.”

The court determined that Fritz needs a guardian in order to prevent additional harm to his health. The court decided that “appointing a guardian and conservator is necessary to avoid immediate harm to him.”

This story really breaks my heart. We send Frank Fritz our best wishes for wellness and recovery.

Tell your friends and relatives about this so they can pray for the well-being of their beloved TV show presenter and learn what happened to him.

What’s fair in this case?

Moving in together is a big step in any relationship. It symbolizes commitment, partnership, and the exciting journey of sharing a home. But let’s be honest—living together also comes with financial realities that can’t be ignored. One of the most common dilemmas couples face is how to fairly split rent when income levels are unequal.

Consider this scenario: A man earns $65,000 per year, while his partner earns $33,000 per year. Together, they are renting an apartment for $2,000 per month. Should they split the rent 50/50, or is there a better way to handle it?

Let’s dive into the different approaches and find the fairest way to split rent without creating financial strain or resentment in the relationship.

Assessing Income Disparities in Cohabiting Couples

It’s rare for couples to earn the exact same income, and when one person earns significantly more, a strict 50/50 split may not be the best solution.

A 50/50 division might feel fair on paper, but in practice, it could financially strain the lower-earning partner, making them struggle to cover other essential expenses like groceries, utilities, and savings.

Instead of treating rent like a simple split, it’s important to evaluate each person’s income, debts, and financial responsibilities to find a balance that respects both partners’ financial health.

Method 1: Splitting Rent Based on Income Proportion

One of the fairest ways to split rent when incomes are unequal is by dividing it proportionally based on each partner’s earnings.

In this case:

- The man earns $65,000 annually, which is 66% of the total income.

- The woman earns $33,000, which is 34% of the total income.

- Applying these percentages to the $2,000 rent:

- The man would pay $1,320 (66%)

- The woman would pay $680 (34%)

This method ensures that both partners contribute relative to what they can afford, preventing financial strain on the lower-income partner.

Video : What rights do cohabiting couples have?

Method 2: Using a Fixed Percentage of Income for Rent

Another approach is for both partners to contribute the same percentage of their individual income towards rent.

For example, if they agree to allocate 30% of their income to rent:

- The man would pay $1,625 per month (30% of his $65,000 annual income divided by 12).

- The woman would pay $825 per month (30% of her $33,000 annual income divided by 12).

This approach ensures that both individuals spend the same proportion of their income on housing, making it fairer and more sustainable.

Method 3: Balancing Costs with Other Household Expenses

Sometimes, splitting rent isn’t just about the rent itself. Couples can balance their financial contributions by dividing other household costs differently.

For example:

- If they split rent equally, the lower-income partner can contribute more towards groceries, utilities, and household chores to compensate for the difference.

- Alternatively, the higher-earning partner can take on larger financial responsibilities, such as paying for furniture, car payments, or entertainment expenses.

This method works best when both partners agree on what feels fair and sustainable in the long run.

The Key to Success: Open and Honest Communication

Money can be a touchy subject, but avoiding financial discussions leads to misunderstandings, stress, and resentment. To create a successful co-living arrangement:

- Have an open conversation about finances before moving in together.

- Discuss income, debts, savings goals, and spending habits to ensure transparency.

- Agree on a financial plan that works for both partners—whether that means proportional rent, shared expenses, or a mix of both.

- Revisit and adjust the agreement as incomes and financial situations change over time.

The goal isn’t just to split rent fairly—it’s to build trust and financial harmony in the relationship.

Other Shared Expenses: What Else Needs to Be Considered?

Rent isn’t the only financial commitment when living together. Couples should also plan for:

- Utilities (electricity, water, internet)

- Groceries and dining out

- Car payments or transportation costs

- Streaming services, gym memberships, and subscriptions

- Savings for vacations or emergencies

A simple budgeting plan that includes all shared expenses helps both partners contribute fairly while ensuring financial stability.

Financial Stress and Relationship Strain: How to Avoid Conflict

Money is one of the top reasons couples argue, especially when income disparities exist. Here’s how to avoid unnecessary stress:

- Set Clear Expectations – Before moving in, agree on how to divide rent and expenses in a way that feels fair to both.

- Avoid Keeping Score – Instead of focusing on exact numbers, consider overall contributions to the household. One partner may contribute more financially, while the other handles more household responsibilities.

- Be Flexible – Financial situations change. One partner may get a raise, lose a job, or take on unexpected expenses. Be willing to adjust contributions as needed.

- Respect Each Other’s Financial Goals – If one person is saving aggressively for the future, while the other prefers a more relaxed spending approach, find a middle ground that supports both perspectives.

Legal Considerations for Cohabiting Couples

Even though cohabiting partners aren’t legally married, financial responsibilities can still have legal implications. It’s a good idea to:

- Put both names on the lease to ensure equal housing rights.

- Consider a cohabitation agreement outlining rent payments and shared financial responsibilities.

- Discuss property ownership if purchasing a home together in the future.

Legal planning might seem unnecessary, but it can prevent potential conflicts or misunderstandings down the line.

Video : The Secret to Financial Success as a Couple…

Conclusion: The Best Approach Is One That Works for Both Partners

There’s no one-size-fits-all rule when it comes to splitting rent as a couple. The most important thing is to find a method that feels fair, manageable, and sustainable for both partners.

Whether you divide rent proportionally, set a fixed percentage of income, or balance expenses in other ways, the key to success is open communication, mutual respect, and financial transparency.

Living together is about building a future—not just sharing a space. By handling financial discussions with maturity and fairness, couples can create a harmonious and stress-free home environment.

How do you and your partner handle rent and expenses? Share your thoughts in the comments below!

Leave a Reply