When Heather’s five-year-old daughter refuses to draw her father in her paintings, her heart breaks. Heather eventually presses Lily for an answer, and when she does, Lily shares a shocking revelation about a secret her dad has been keeping. Heather is rendered speechless by the news, which reveals a side of their life that she never would have suspected. I listened to the worried voice of Lily’s teacher while sitting on the couch with the phone pressed to my ear.”Heather, how are things going at your house?” Mrs. Thompson enquired politely.

An knot of worry tightened in my gut. I said, “Mrs. Thompson, what’s the deal?” On the other end, she let out a quiet sigh. We asked the children to create portraits of their families today. Lily only drew herself, you, and her older brother Liam. She became silent and clammed up when I asked her where her dad was.My heart fell. I looked over at Lily, who was on the carpet playing with her toys. Her tiny face exuded such innocence and joy. “Oh, I understand,” I said in a firm voice.

Her dad hasn’t been around much these days, though. We’ve been going through some difficult times.Heather, I get it. Simply put, Lily appeared somewhat reticent when I asked her. Perhaps there was more going on, I reasoned.I inhaled deeply as I attempted to collect my thoughts. I appreciate you informing me of this, Mrs. Thompson. I’ll discuss it with Lily. Naturally, Heather. Please don’t hesitate to contact us if you need any assistance. We want to make sure Lily, who is a lovely girl, is doing well.An old woman talking on the phone I said, “Thank you,” with a mixture of concern and thankfulness.

“I will see to it.” I gave Lily another look as I hung up. She held out one of her dolls and grinned at me. “Observe, mother! She’s got on a lovely dress! I feigned a laugh. I said, “She sure is, sweetheart.” A young girl having fun with a doll. I had to figure out how to bring up Lily’s father with her without upsetting her. I inhaled deeply. Why didn’t you draw Daddy when you were in kindergarten, sweetie? Has he done something that has angered you? Trying to sound as nice as possible, I asked. With reluctance in her large eyes, Lily raised her gaze to me. “Mommy, I can’t tell you.”I squatted down next to her. “Why, my dear? Tell your mother everything you want to. She bit her lip with hesitation. At last, she grasped my hand and murmured, “All right, Mommy, I’ll show you.”

She moved some old crates aside and took me to a corner of the garage. She brought an old, dusty scrapbook out from behind them and gave it to me, her expression sad. “Mom, look inside.”A dejected young girl clutching a photo album. With shaky hands, I opened the album. It was crammed with pictures and sketches, a mixture of joyful events and carefree sketches.

But one page stopped me cold. It was a picture of a man who looked strikingly like my husband but with subtle differences. He was standing with a woman and two children, none of whom I recognized. A kid removing photos from a book with an adult sitting beside them. My heart pounded in my chest as I stared at the photo. “Lily, where did you find this?” She pointed to the back of the garage. “I found it when I was looking for my old toys.” I sat down on an old stool, feeling a wave of confusion and fear wash over me. Could it be true? Could David have a second family? I didn’t want to believe it, but the evidence was right in front of me.

“Mommy, are you okay?” Lily asked, her voice small and worried. I pulled her into a hug, trying to hide my anxiety. “I’m okay, sweetheart. Thank you for showing me. We’ll figure this out together, okay?” She nodded, and I held her close, my mind racing with questions and doubts. That night, with my heart heavy and mind swirling, I confronted David in our bedroom.

The scrapbook lay open on the bed, its pages filled with secrets I never imagined. “Care to explain this?” I demanded, my voice shaking as I pointed to the incriminating photos. David’s face went pale. He sighed heavily and sat down, his hands trembling.“I–I’m sorry, Heather,” he said. “I was going to tell you, but I didn’t know how.” “You have another family? How could you do this to us?” I yelled, tears streaming down my face, my anger mixing with overwhelming sorrow. “It’s not what you think,” he said, his voice breaking. “Before I met you, I was married. We had two children, but my wife and one of the kids died in a car accident.

The surviving child, my son, lives with his grandmother. I couldn’t bear to talk about it.”I stood there, stunned. This revelation was more than I could process. “Why didn’t you tell me?” I managed to ask. “I didn’t want to bring the pain into our lives. I wanted to start fresh with you,” he explained, tears welling up in his eyes. His pain was evident, but so was mine. I sat down beside him, trying to absorb his words. The betrayal and the hidden past felt like too much to handle.“You should have trusted me, David,” I said. “We could have faced this together.” He nodded, wiping away a tear. “I know. I’m so sorry, Heather. I just didn’t want to lose you.” I sighed, my anger slowly giving way to empathy. “We’ll need time to work through this, but keeping secrets isn’t the way. We need to be honest with each other.”The next few days were a whirlwind of emotions.

I needed time to process everything. As I sat in my room one evening, staring at the scrapbook, a thought struck me. If Lily found this, could there be more secrets hidden in our home? Determined, I began searching the house. I went through drawers, old boxes, and forgotten corners, looking for anything that might reveal more of David’s past. In the attic, I found a hidden stack of letters and documents. My heart pounded as I sifted through them. One letter, in particular, stood out. It was from a law firm, detailing a large inheritance left to my husband by his late wife. The money was in a trust, and he had never mentioned it to me. I sat down on the attic floor, the letter trembling in my hands. The betrayal cut deep. Why hadn’t he told me about this? What else was he hiding? My mind raced with questions, and a new wave of anger and hurt washed over me. I had to confront him again, but this time, I needed answers.

That evening in the kitchen, the air was thick with tension. I placed the inheritance letter on the table in front of David as he sat down. Lily was in the living room, playing quietly. “You kept this inheritance a secret. Why? I thought we’d promised each other not to keep secrets.” He looked down, avoiding my gaze. “I feared it would change things between us, Heather. I thought if you knew, it would complicate everything.”How could you think hiding something so important would help us? It’s about trust, David. And right now, that trust is shattered!” He sighed deeply, his shoulders slumping. “I’m sorry, Heather. I really am. I never meant to hurt you. I just didn’t know how to handle it.” “We can’t go on like this, with secrets and lies.

We need transparency for our sake and for Lily’s,” I said, my voice softening slightly. “Can you promise me that?”David looked up, tears in his eyes. “Yes, I promise. No more secrets.” Just then, the phone rang. I picked it up, and an unfamiliar voice spoke. “Hello, Heather. This is Eleanor, David’s late wife’s mother. I’d like to meet Lily and Liam.” I was taken aback. I put the phone on speaker mode. “Eleanor, I didn’t expect this call. Why now?”“I think it’s time the half-siblings met. They deserve to know each other,” she replied gently. “Got your number from David long ago. Couldn’t find the courage to call you before today.” I glanced at David, who looked equally surprised. “We’ll arrange something soon,” I said, feeling a mixture of apprehension and hope. As I hung up the phone, I turned to David. “Eleanor wants Lily and Liam to meet their half-brother.”David nodded, his expression serious. “It’s about time. We need to bring our families together.” I hoped this was the beginning of a new chapter, one where honesty and healing could finally take root.

The next weekend, we arrived at Eleanor’s house, a warm and inviting place filled with memories. Photos of David’s past adorned the walls, a silent reminder of the life he had before us. Eleanor greeted us at the door.“Hello, Heather. I’m glad you came,” she said, giving me a gentle hug. “Come in, everyone.” We stepped inside, and I immediately felt the warmth of her home. Ethan, David’s surviving son, stood by the fireplace, looking nervous. Lily and Liam clung to my sides, their eyes wide with curiosity. “Ethan, these are your half-siblings, Lily and Liam,” Eleanor said, introducing them. Ethan smiled shyly. “Hi, Lily. Hi, Liam.” Lily took a step forward, her natural curiosity taking over. “Hi, Ethan. Do you like dinosaurs?” Ethan’s face lit up. “I love dinosaurs! Do you want to see my collection?”Lily nodded eagerly, and the two of them ran off to Ethan’s room, leaving us adults to talk.

I watched them go, feeling a sense of relief. Eleanor led us to the living room, where we sat down and began to talk. The conversation was emotional, filled with tears and apologies. David and Eleanor shared stories of the past, and I could see the pain and love in their eyes. A smiling elderly woman | Source: Pexels “Forgiveness and understanding can help us rebuild. We’re a family, and we need each other,” Eleanor said. I nodded, knowing she was right. Our family was fractured, but I could see a path to healing. It wouldn’t be easy, but together, we could rebuild stronger.

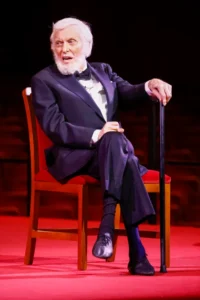

Dick Van Dyke, 98, Shocks Fans with Sudden Public Appearance Cancellation—Find Out Why

American actor and comedian Dick Van Dyke has canceled his much-anticipated appearance at the FanX Salt Lake Comic Convention. Fans are now worried and sending their prayers.

FanX shared the news on September 21 via a statement on social media and their website.

“We regret to inform you that Dick Van Dyke cannot travel to FanX. He appreciates all the support from his fans, but at almost 99 years old, traveling and meeting thousands of people is more than he can handle right now,” the statement said.

The message emphasized that although Van Dyke is still loved by many fans, the physical demands of public appearances have become too difficult for the legendary entertainer.

Once the news broke, fans quickly took to social media to share their thoughts and prayers for the beloved actor. Many recognized how demanding public events can be for someone approaching their 99th birthday, but they still expressed their worry and love for him.

Dick Van Dyke’s lighthearted remark about praying to make it to his 99th birthday perfectly captures the candid and playful spirit he’s always had, even when discussing his health.

With his December 13 birthday approaching, fans are rallying around him, sending prayers and positive messages. They all share the same hope—that he stays healthy and happy for many more years to come.

Leave a Reply